The Hidden Value of a QoE: Better Diligence, Better Audits

For searchers, a Quality of Earnings (QoE) engagement does more than support a transaction. It sets the foundation for smoother financial reporting...

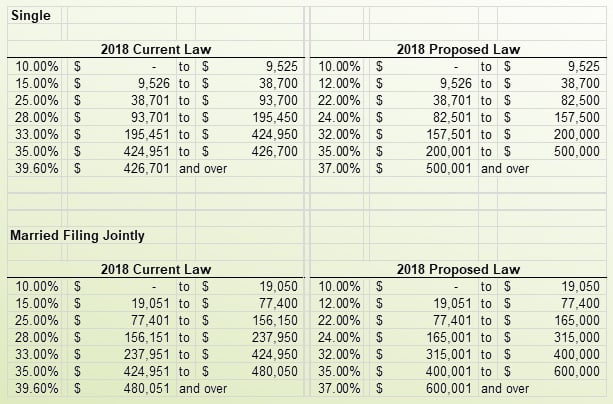

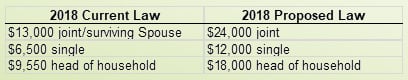

November 19, 2017 — On Friday, December 15, 2017, the Conference Committee released a reconciled version of the "Tax Cuts and Jobs Act". The House and Senate have since voted it into law.

Below is a summary of some of the major provisions of the bill.

For searchers, a Quality of Earnings (QoE) engagement does more than support a transaction. It sets the foundation for smoother financial reporting...

In most M&A conversations, risk can be oversimplified too quickly. Buyers ask, “What if we overpay?” Sellers worry, “What if we leave money on the...

For independent searchers, structuring the right deal isn’t just about finding a great business. It’s about creating the right balance between risk...