Creative Deal Structuring for Independent Searchers: Balancing Price, Risk, and Growth

For independent searchers, structuring the right deal isn’t just about finding a great business. It’s about creating the right balance between risk...

3 min read

Emmett Mulcahy, CPA, CVA

:

August 26, 2019

Emmett Mulcahy, CPA, CVA

:

August 26, 2019

August 26, 2019 — If you have ever used a CPA firm for attestation work, you may be familiar with the three levels of financial statement service: audit, review, and compilation. Each of these levels of service offers a different degree of assurance, and determining the right level of service is dependent on the facts and circumstances of each business owner’s situation.

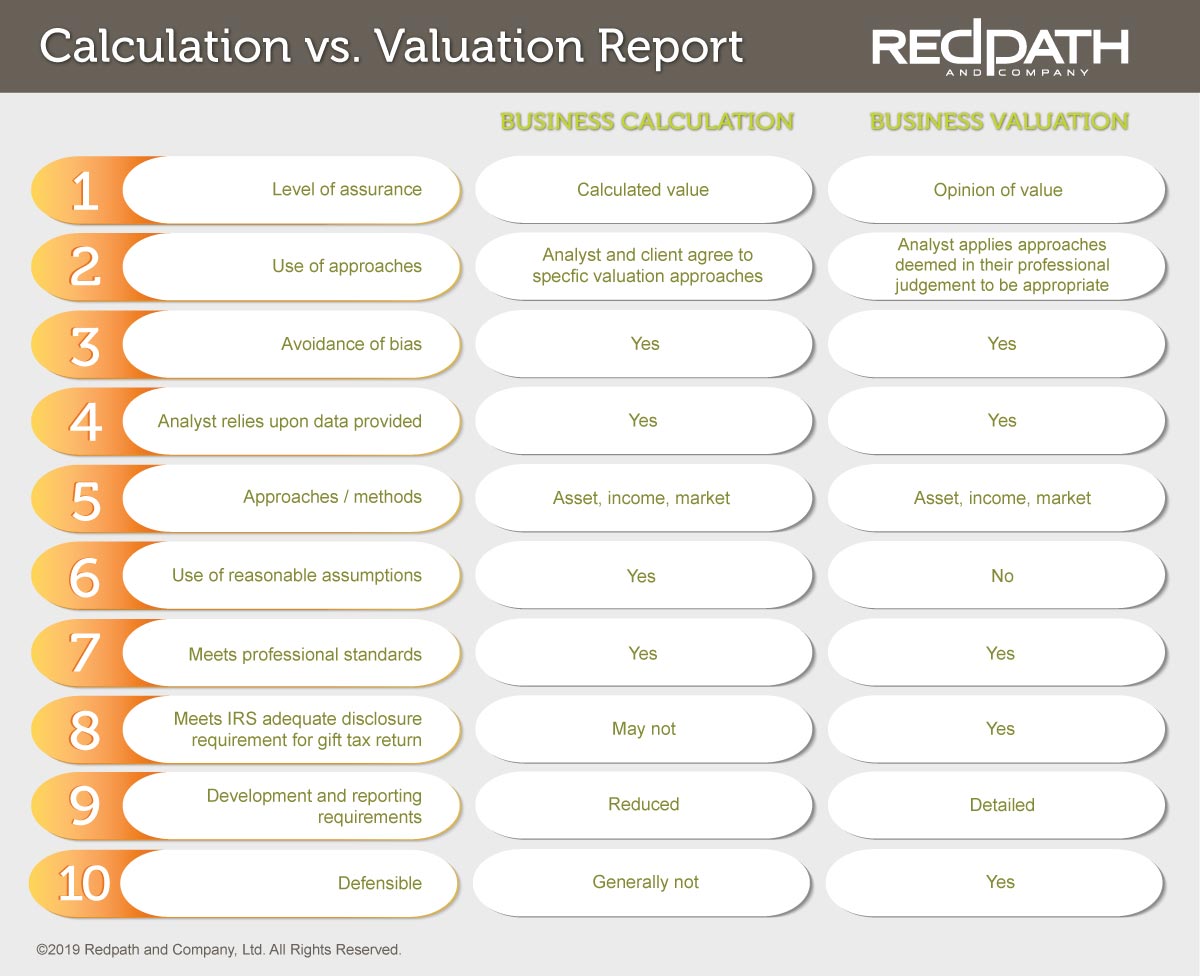

Similarly, a business valuation analyst also offers different levels of service—a calculation engagement and a valuation engagement. A proper understanding of the differences between these engagements and the corresponding business valuation reports produced will help facilitate better conversations between the business owner and their valuation analyst. The outcome of those conversations will help ensure that the right level of service is being performed for the business owner based on their unique needs.

The American Institute of Certified Public Accountants (AICPA) in their Statement on Standards for Valuation Services (SSVS) defines the two types of business valuation engagements as the following:

A valuation analyst performs a calculation engagement when:

(1) the valuation analyst and the client agree on the valuation approaches and methods the valuation analyst will perform in the process of calculating the value of the subject interest (these procedures will be more limited than those for a valuation engagement), and

(2) the valuation analyst calculates the value in compliance with the agreement.

Since a calculation engagement will not include all of the procedures required for a valuation engagement, the analyst will express the results of their procedures as a calculation of value. A calculation of value may be suitable for strategic planning, non-contested divorce cases, or executing a buy/sell agreement.

A valuation analyst performs a valuation engagement when:

(1) the engagement calls for the valuation analyst to estimate the value of the subject interest, and

(2) the valuation analyst estimates the value and is free to apply the valuation approaches and methods they deem appropriate considering the circumstances.

The valuation analyst expresses the results of the valuation as a conclusion of value. A conclusion of value is required for gift and estate tax filings.

Aside from the agreement of procedures and methods to be utilized within a business valuation report, the main difference between the two levels of service is the allowance of reasonable assumptions to be utilized in a calculation engagement. In the context of a calculation engagement, a reasonable assumption can be the basis for critical valuation inputs such as rates of return, market multiples, and discounts for lack of marketability or lack of control, along with many other factors.

The use of reasonable assumptions is also what enables the calculation engagement to be performed at a lower cost—and in a more condensed time frame—relative to a valuation engagement. However, the calculation engagement also comes at the cost of less analysis contained within the report. It is this trade-off between cost and depth of analysis that is essential for business owners to understand when deciding which level of service is appropriate for their specific valuation needs.

Business owners and valuation analysts will weigh cost considerations, timing, data limitations, and other factors against the defensibility of any end product produced by the valuation analyst. Given the differences in levels of diligence and analysis between the two types of engagements, the results of a calculation engagement may not hold the same weight as the results of a valuation engagement. Determining if that trade-off is acceptable will come down to the reasons for needing a value of the business.

A calculation engagement may be appropriate for planning purposes, initial buy/sell agreements, preliminary negotiations, merger and acquisition activity, and other instances when opinions of value from a valuation analyst don’t need to hold up to scrutiny to some sort of authority.

While calculation engagements are useful for a multitude of reasons, valuation engagements should be utilized in any instance when the value of a business needs to be determined for some authority figure. Examples include:

The inherent differences between a valuation engagement and calculation engagement are important for business owners to understand as they weigh their options when engaging with a valuation professional. This understanding will help facilitate better discussions with the valuation analyst and will provide the best outcomes that meet their specific and unique needs.

Read Part 1 of this series: What Factors Contribute to the Valuation of a Company?

Read Part 3 of this series: Business Valuation Approaches: Asset, Income and Market Approach

Read Part 4 of this series: Standard of Value: Recognizing the Differences

For independent searchers, structuring the right deal isn’t just about finding a great business. It’s about creating the right balance between risk...

ST. PAUL, MN – February 3, 2026 – Redpath and Company is pleased to welcome Mike Dunkle as a Partner in the firm’s Transaction Advisory practice....

The Redpath and Company BottomLine Newsletter ishere!