Advanced ESOP Accounting Topics: Warrants, SARs, and Planning Ahead

For companies entering or operating within an ESOP, the transaction itself is often the headline moment. Ownership changes, employees become owners,...

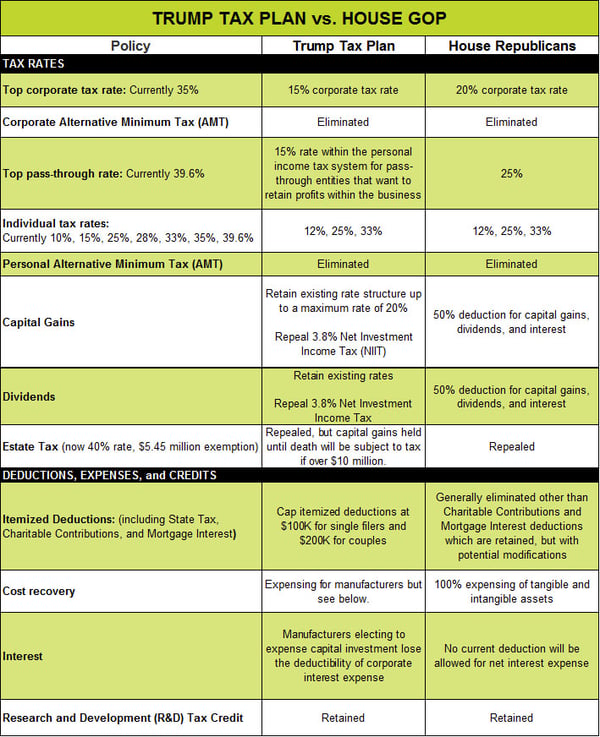

November 17, 2016 — As we approach the end of 2016, many taxpayers are starting to plan for their upcoming tax filings. While this is important every year, the benefits of good year-end tax planning could be even more dramatic this year as a result of the 2016 elections. With the election of Donald Trump and control of the House and Senate retained by the Republicans, it is likely the President-elect will be able to enact some of the tax cuts discussed during the campaign.

Individual Rates

One of the key topics discussed as part of tax reform have been the tax rates. Current individual tax rates are split between seven tax brackets with a top rate of 39.6%. The rate can be even higher (43.4%) when the additional 3.8% net investment income tax is taken into account. Both the House Republications and Trump plan to reduce the tax brackets from seven to three with the top rate at 33%. In addition, the individual alternative minimum tax system would be eliminated as would the additional 3.8% net investment income tax.

Business Rates

Both Trump and the House Republicans want to lower the tax rates for businesses. Currently pass-through entities (partnerships and S corporations) pay tax at the individual rates and C Corporations pay tax at a top corporate rate of 35%. Under the two proposals corporate alternative minimum tax would be eliminated and the top rate would be reduced to either 15% or 20%. Flow through entities would have a separate rate on the individual return with a top rate of either 15% or 25%.

Business

In order to pay for the reduction in rates and as part of their goal of simplification, many deductions will be eliminated. While specifics remain to be seen it appears that the research credit will be retained and under one proposal the LIFO inventory method. However, both Trump and the House Republicans will allow for increased expensing of capital acquisitions. This varies from only applying to manufacturers to allowing complete expensing of all capital acquisitions (including intangible assets).

Individual

Currently taxpayers can choose between claiming itemized deductions (out of five categories) or claiming a standard deduction. In addition there are personal exemptions for taxpayers and their dependents subject to phase outs at higher income levels. Both Trump and the House Republicans plan to simplify this by allowing one larger standard deduction. The treatment of itemized deductions would vary significantly from eliminating all of them except charitable and mortgage interest (with potential modifications) to an overall cap on itemized deductions up to $200,000.

In light of the potential for significant tax reform next year, taxpayers should consider deferring income and accelerating deductions. A deduction in 2016 could be more valuable than a deduction in 2017.

Example

An individual owns 100% of an S corporation. By prepaying expenses and accelerating equipment purchases, the individual can create additional current deductions of $1 million. Today those deductions have the potential to reduce federal taxes by $396,000. If tax reform is completed next year and the House Republican plan is enacted for flow through income, the same deductions have the potential to reduce taxes by $250,000 next year. Taking the deduction today could lower taxes in the aggregate by $146,000.

Another thing to consider would be to accelerate charitable contributions and state tax payments. In light of the potential for an upcoming cap on itemized deductions (and the rate change discussed above) the deduction has the potential to be more valuable today. To the extent of a current tax benefit, prepaying state taxes and maximizing charitable contributions could be advisable.

While specific policies and timing that would be part of any potential tax reform remain to be seen, it seems clear that the objective will be to lower the tax rates and eliminate or minimize some of the deductions. As a result, deductions taken now not only defer current tax but have the potential to lower the overall tax liability. Taxpayers should carefully consider the timing of certain payments and acquisitions in order to maximize their overall benefit.

If you would like to speak to someone about tax planning and how President-elect Trump's tax policies could impact you or your business, contact John Kammerer at 651-255-9305 or email jkammerer@redpathcpas.com.

For more information about Republican or Trump tax policies, you can visit https://abetterway.speaker.gov/_assets/pdf/ABetterWay-Tax-PolicyPaper.pdf or https://www.donaldjtrump.com/policies/tax-plan.

For companies entering or operating within an ESOP, the transaction itself is often the headline moment. Ownership changes, employees become owners,...

For searchers, a Quality of Earnings (QoE) engagement does more than support a transaction. It sets the foundation for smoother financial reporting...

In most M&A conversations, risk can be oversimplified too quickly. Buyers ask, “What if we overpay?” Sellers worry, “What if we leave money on the...