The Hidden Value of a QoE: Better Diligence, Better Audits

For searchers, a Quality of Earnings (QoE) engagement does more than support a transaction. It sets the foundation for smoother financial reporting...

2 min read

Gloria McDonnell, CPA

:

June 19, 2018

Gloria McDonnell, CPA

:

June 19, 2018

June 19, 2018 — Can you itemize, or will you be claiming your new standard deduction? Once you understand the levers available, you’ll know which among them you can pull when it comes to paying Uncle Sam.

For one, you may be able to maximize your personal deduction through bunching. It’s a great way to ensure that your deductions will exceed the new standard deduction thresholds and is an especially great tax planning strategy in a year in which you know that you will have a higher than normal income.

Let’s say you were expecting to sell a business or investments. In that case, you might expect that your income would be substantially higher than in other years. Bunching is the idea that you would attempt to soothe some of the sting by considering the timing of controllable expenses, such as:

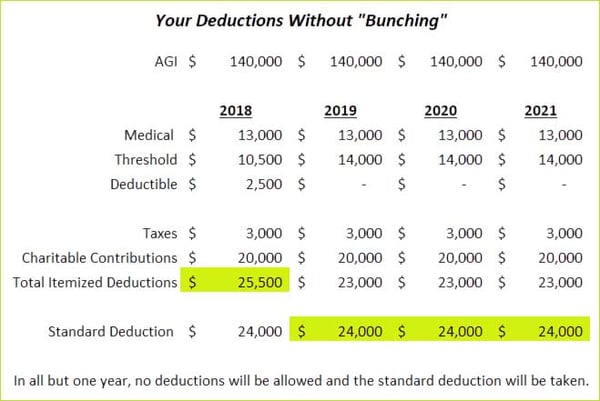

Example: Assume Mr. and Mrs. Smith have adjusted gross income of $140,000 annually. They pay annual medical expenses of $13,000, make annual donations of $20,000 to their favorite charities, and pay taxes of $3,000 per year.

Copyright 2018 Redpath and Company. All Rights Reserved.

Copyright 2018 Redpath and Company. All Rights Reserved.Figure 1. An example of no bunching.

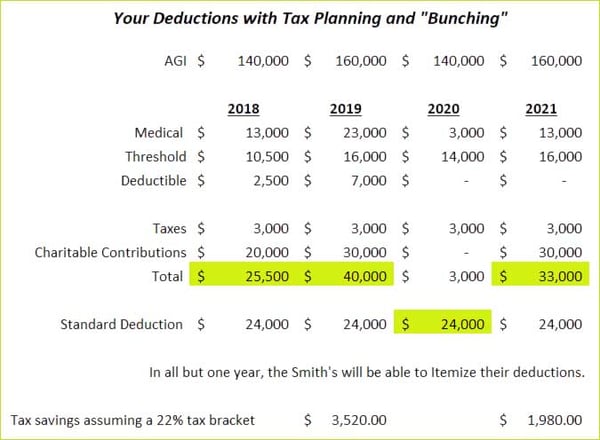

Now assume the Smiths will receive additional investment income of $20,000 in 2019 and 2021. By bunching, they are going to reallocate some of their medical expenses and donations to those years.

Copyright 2018 Redpath and Company. All Rights Reserved.

Copyright 2018 Redpath and Company. All Rights Reserved.Figure 2: What can bunching do for you? (or the Smiths?)

Standard and Itemized Deductions prior to TCJA and after the TCJA were changed like this:

| Standard Deductions in the Past | Standard Deductions Post Tax Reform |

| $13,000 joint/surviving spouse | $24,000 joint |

| $6,500 single | $12,000 single |

| $9,550 head of household | $18,000 head of household |

Major changes to Itemized deductions include:

For searchers, a Quality of Earnings (QoE) engagement does more than support a transaction. It sets the foundation for smoother financial reporting...

In most M&A conversations, risk can be oversimplified too quickly. Buyers ask, “What if we overpay?” Sellers worry, “What if we leave money on the...

For independent searchers, structuring the right deal isn’t just about finding a great business. It’s about creating the right balance between risk...