The Hidden Value of a QoE: Better Diligence, Better Audits

For searchers, a Quality of Earnings (QoE) engagement does more than support a transaction. It sets the foundation for smoother financial reporting...

2 min read

Gloria McDonnell, CPA

:

January 11, 2018

Gloria McDonnell, CPA

:

January 11, 2018

January 11, 2018 — While human-level artificial intelligence is still a long way off, the increased use of robots to automate manufacturing processes has become the norm. Increasingly, manufacturing companies of all sizes have become roboticized in pursuit of time and money savings. Will the movement toward more automation as a result of the robotics revolution lead to a new kind of tax in the future?

There’s no doubt that robotics is having a transformative impact on the manufacturing industry. But there are questions being raised in and out of the industry due to the robotics movement. The two most pressing questions in the age of automation are:

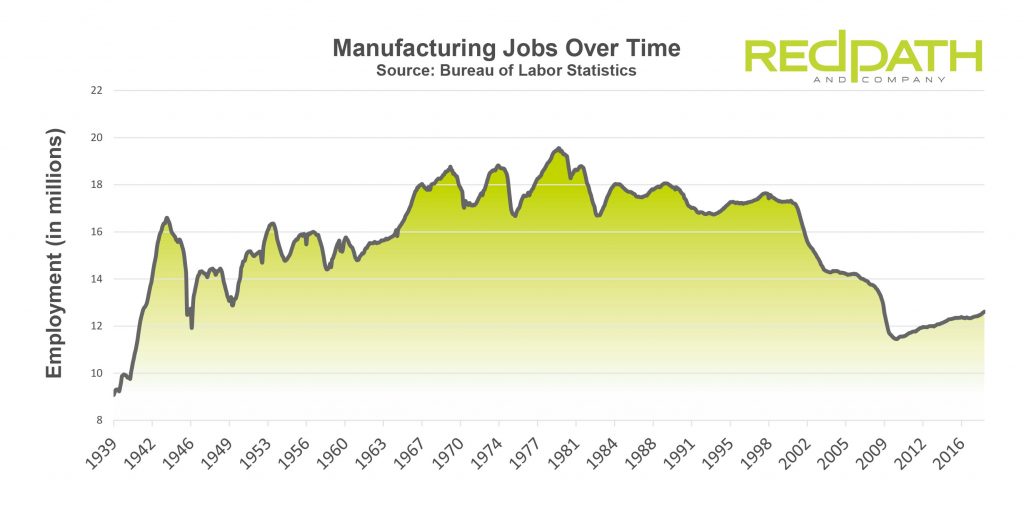

Around 88 percent of all job losses in the manufacturing industry can be tied to growth in productivity, and much of this decline can be attributed to robotic automation. While robots often boost efficiency and earnings, there are questions as to how deeply robotics should be utilized within manufacturing as a whole.

Change in U.S. Manufacturing Jobs Over Time - Redpath and Company

Change in U.S. Manufacturing Jobs Over Time - Redpath and CompanyFor example, should the manufacturing workforce be completely automated? Should skilled employees perform specific and more complex tasks? Until these questions are fully answered, the future of the manufacturing industry remains uncertain.

What is certain is that the robotics revolution continues to speed forward—and there seem to be more reasons to continue the rapid pace of automation than there are against it. Jonathan Tilley of global management consulting firm McKinsey and Company, identifies some factors as enabling the automation movement, including:

Robots are also being used to perform dangerous or arduous tasks in the industry. For example, mining operators often have their workers operate trucks remotely to avoid exposing humans to risk.

The case for and against automation in the manufacturing industry has strong supporters on both sides of the argument. Automation can’t be ignored as a means to minimize safety risks to workers, and neither can its impact on the manufacturing workforce due to job displacement.

The idea of implementing a robot tax has been discussed by many within business and government, including Bill Gates. It would work like this: if a worker is replaced by a robot, the resulting reduction in income and Social Security taxes would be assessed to the business.

The logic is that the business could realize a net profit from replacement of the employee—due to efficiencies gained in automation - and the government would be able to collect lost taxes as a result of the replaced worker.

Gates claims that the idea is not to stymie innovation and efficiency gains as a result of automation, but to slow its growth in the industry to give workers a chance to “catch up.” The premise is that if you take the employee that was replaced by automation and are able to retrain them to perform other tasks, then you’re net ahead. And currently, the displacement of workers as a result of robotics is seen as a net loss.

According to Gates, tax on automation would allow us to take a step back, look at how displacement is affecting workers, analyze transition programs, and figure out how to fund them.

While the idea of a robot tax is just being floated in the U.S., South Korea is already taking steps toward eventually adopting some form of robot tax. Their version includes decreasing tax incentives for companies that automate their manufacturing processes. The aim is not to slow innovation and miss out on the efficiency gains of automation, but rather to seek a balance between steady tax revenue and improvements in manufacturing productivity.

It’s difficult to predict how or when taxes may be introduced in the U.S. to account for automation, but it never hurts to keep a finger on the pulse of ideas and potential policies that may affect the manufacturing industry.

If you’d like to discuss your current tax exposure or any other accounting needs, you can contact Redpath CPAs today.

For searchers, a Quality of Earnings (QoE) engagement does more than support a transaction. It sets the foundation for smoother financial reporting...

In most M&A conversations, risk can be oversimplified too quickly. Buyers ask, “What if we overpay?” Sellers worry, “What if we leave money on the...

For independent searchers, structuring the right deal isn’t just about finding a great business. It’s about creating the right balance between risk...