The Hidden Value of a QoE: Better Diligence, Better Audits

For searchers, a Quality of Earnings (QoE) engagement does more than support a transaction. It sets the foundation for smoother financial reporting...

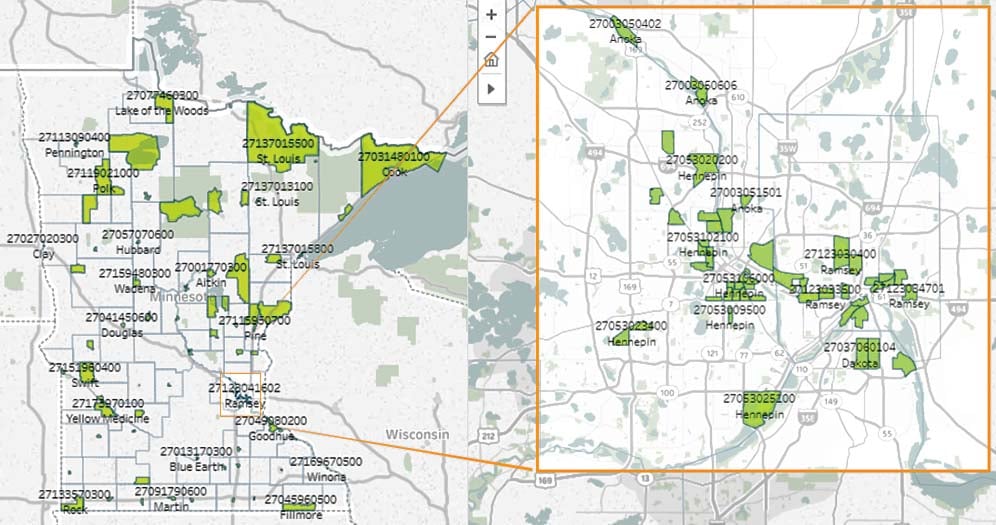

August 28, 2018 —There is an exciting tax-saving opportunity for those investing in designated zones across the country, including within our own metro area. These zones are designed to encourage economic development and create jobs in areas with significant untapped economic potential.

In accordance with H.R.1 Tax Cut and Jobs Act of 2017, Governor Dayton nominated 128 census tracts for designation as a qualified opportunity zone. On May 18, 2018, the U.S. Department of Treasury certified and formally designated these census tracts as qualified Opportunity Zones. See more information on Minnesota opportunity zones at https://mn.gov/deed/business/financing-business/tax-credits/opp-zones/

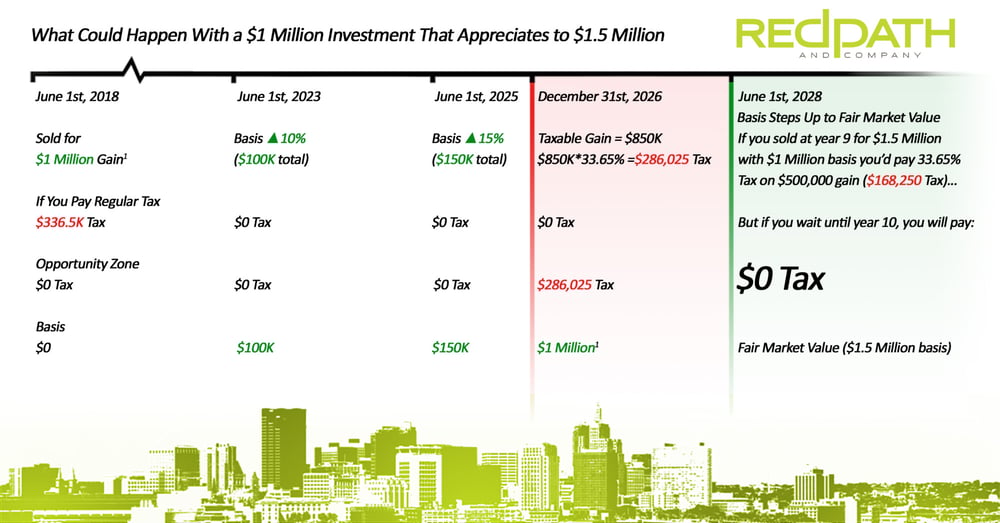

If you’ve sold a piece of property or an investment for a significant gain, you can defer the gain if you invest in a Qualified Opportunity Fund, and also in a Qualified Opportunity Zone, often within 180 days of triggering the gain. This will allow you to defer paying tax on the sale until December 31, 2026 (2027 tax filing season). Two main factors: you have to a) sell something for a gain, and b) you have to want to invest in something else.

In order to take advantage of the Opportunity Zone program, participants need to invest in a Qualified Opportunity Zone Fund (QOF). A QOF is any investment vehicle organized as a domestic corporation or partnership for the purpose of investing in a Qualified Opportunity Zone (QOZ) property (other than another QOF). Any capital gain from the sale to, or exchange with, an unrelated person of any property held by the program participant(s) prior to 12/31/2026 can be deferred to the extent the gain is reinvested in a QOF.

For example, two business owners who are 50/50 shareholders sell their business for a $2 million gain. One of the shareholders wants to retire, but the other wants to invest in a new construction project in St. Paul.

Shareholder One takes the money and pays tax on their share of $1 million gain at a 33.65% tax rate. They will pay $336.5K in tax and retire with $663.5k of cash in their pocket.

Shareholder Two takes $1 million from the sale (equal to their gain), and invests into a QOF:

Copyright 2018 Redpath and Company. All Rights Reserved.

Copyright 2018 Redpath and Company. All Rights Reserved.In the above example you would enjoy all of the following:

If you keep your money in an opportunity zone for a minimum of 10 years, there could be a tremendous opportunity for you.

For searchers, a Quality of Earnings (QoE) engagement does more than support a transaction. It sets the foundation for smoother financial reporting...

In most M&A conversations, risk can be oversimplified too quickly. Buyers ask, “What if we overpay?” Sellers worry, “What if we leave money on the...

For independent searchers, structuring the right deal isn’t just about finding a great business. It’s about creating the right balance between risk...