3 Questions to Find the Right Accounting Partner for Your Construction Business

This article was originally written in October 2020. It has been updated with new references and information.

2 min read

Alex Helkamp, CPA, CCIFP

:

March 20, 2018

Alex Helkamp, CPA, CCIFP

:

March 20, 2018

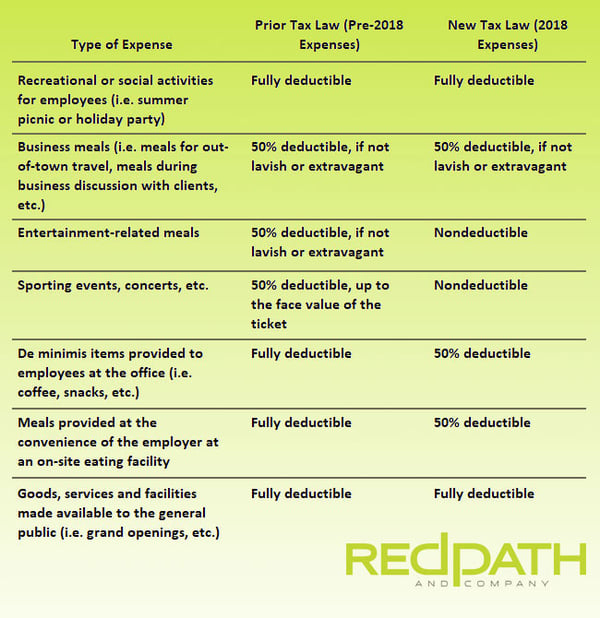

March 20, 2018 — As part of the sweeping tax reform passed in December of 2017, there were substantial changes to the deductibility of both business meals and entertainment expenses. The changes for both of these provisions are effective for expenses paid or incurred after December 31, 2017.

Prior to the new law, entertainment expenses directly related to a taxpayer’s trade or business were 50% deductible. Under the new law, anything considered to constitute entertainment, amusement, or recreation is now completely nondeductible, including the cost of facilities used in connection with these activities.

There were a number of changes to the types of meals that are subject to the 50% limitation. Under prior law, meals for the convenience of the employer (de minimis fringe benefits) or meals at on-premises dining facilities were generally fully deductible. These categories of meals will now be 50% deductible.

Business meals still continue to generally be 50% deductible. However, there is some uncertainty as to what will constitute a “business meal” under the new tax law. The only example provided in the Committee Report as a qualified business meal is for meals consumed by employees on work travel. Will meals provided at an entertainment function for prospects or clients (assuming the function also has a bona fide business purpose) continue to be 50% deductible? The tax commentary is divided on this issue, so we are hopeful that IRS guidance will provide further clarity in the future. Generally, business meals with clients where business is conducted, and that are not lavish or extravagant will remain 50% deductible. If minimal or no business is conducted and the meal is related to other entertainment we believe that the meal will be nondeductible as entertainment.

Certain meals and entertainment expenses continue to be 100% deductible, including the following:

Here are changes to deductibility of meals and entertainment expenses following the Tax Cuts and Jobs Act:

In light of these changes, it is important to review how your meals and entertainment expenses are categorized. Under prior law, the characterization between meal and entertainment expenses were irrelevant because the treatment was the same. In light of the new law, it will be important to segregate the entertainment expenses from the meal expenses. Furthermore, de minimis fringe benefits (such as coffee, snacks, and water at the office) were often coded to employee welfare or office supplies but now will need to be treated as 50% non-deductible meals.

This article was originally written in October 2020. It has been updated with new references and information.

Editor's note: this blog was updated in 2025 with additional resources for business owners.

In a significant shift on Friday, March 21, the Financial Crimes Enforcement Network(FinCEN) has revised its Beneficial Ownership Information (BOI)...