Redpath Welcomes Mike Dunkle as a Transaction Advisory Services Partner

ST. PAUL, MN – February 3, 2026 – Redpath and Company is pleased to welcome Mike Dunkle as a Partner in the firm’s Transaction Advisory practice....

2 min read

Jon Fortin, J.D.

:

November 19, 2020

Jon Fortin, J.D.

:

November 19, 2020

November 19, 2020 - If you're looking to transfer wealth, protect your assets, and manage taxes, trusts can help secure a stronger financial future for your business and family. State income tax implications can also affect the way you structure your trusts – and Minnesota's new Schedule M2RT Resident Trust Questionnaire could impact how the state taxes your trust.

Prior to 2018, if your trust met the statutory definition of a Minnesota resident trust, it would always be taxed as a MN resident trust. For instance, a trust created at the death of a MN resident would continue to be a MN resident trust even if the trust and its beneficiaries had no connections to the state.

Two court cases have challenged this interpretation: North Carolina Dept. of Revenue v. Kimberley Rice Kaestner 1992 Family Trust (2019), decided by the US Supreme Court, and Fielding v. Commissioner of Revenue (2018), decided by the Supreme Court of Minnesota. In these cases, the courts ruled that states must respect the Due Process clause of the Fourteenth Amendment and establish a "definite link" between the state and the trust it seeks to tax.

These rulings mean new challenges, opportunities, and paperwork when establishing and managing trusts in the state of Minnesota.

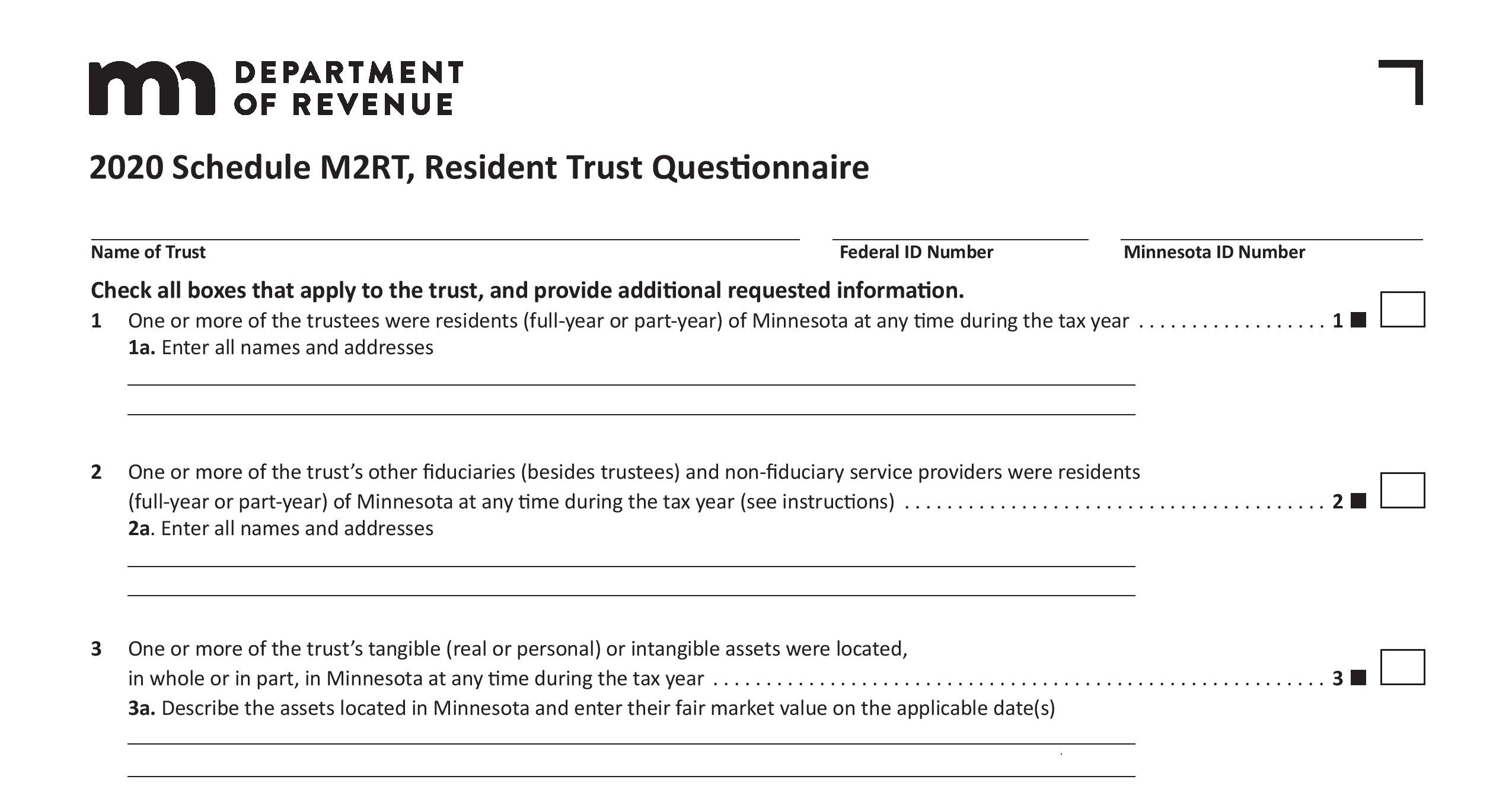

Schedule M2RT is Minnesota's attempt to establish that "definite link" between the state and the trusts, the people who form them, their beneficiaries, the assets they contain, and the trustees who administer them. Any fiduciary who meets "the statutory definition of a resident trust" but believes their trust doesn't have sufficient connections to Minnesota to be taxed as a resident must file Form M2RT with their tax return.

In other words, if the taxpayer feels that they don't meet the minimum connection with the state and the trust shouldn't be taxed in Minnesota, the taxpayer must now give evidence to prove it by completing the Schedule M2RT Resident Trust Questionnaire. It asks respondents to confirm the following details, among others:

From your answers, the Minnesota Department of Revenue can apply due process to make a determination about whether or not your trust should be taxed to Minnesota. If your trust is classified as a Minnesota resident trust and you don't file the Form M2RT questionnaire, it could be taxed as a Minnesota resident trust by default.

It's important to note that the Schedule M2RT questionnaire isn't a test you pass or fail. It only exists to establish the facts of whether or not your trust qualifies as a Minnesota resident trust. Just like the Fielding case was a "facts and circumstances decision," each answer you give on the M2RT is simply another factor in determining the trust residency.

With an understanding of the details (like where, how, and when the trust is written, administered, and invested), your accounting advisor can help you figure out whether or not your trust is classifiable as a Minnesota resident trust.

For more information about the Schedule M2RT form or what you should do when establishing or managing a trust in Minnesota, reach out to me, Jon Fortin, J.D., Tax Director, Estate, Gift & Trust at Redpath and Company, at 651-478-1508 or jfortin@redpathcpas.com.

ST. PAUL, MN – February 3, 2026 – Redpath and Company is pleased to welcome Mike Dunkle as a Partner in the firm’s Transaction Advisory practice....

The Redpath and Company BottomLine Newsletter ishere!

As 2025 drew to a close, the Governmental Accounting Standards Board (GASB) issued Statement No. 105, Subsequent Events. While the requirement to...