3 Questions to Find the Right Accounting Partner for Your Construction Business

This article was originally written in October 2020. It has been updated with new references and information.

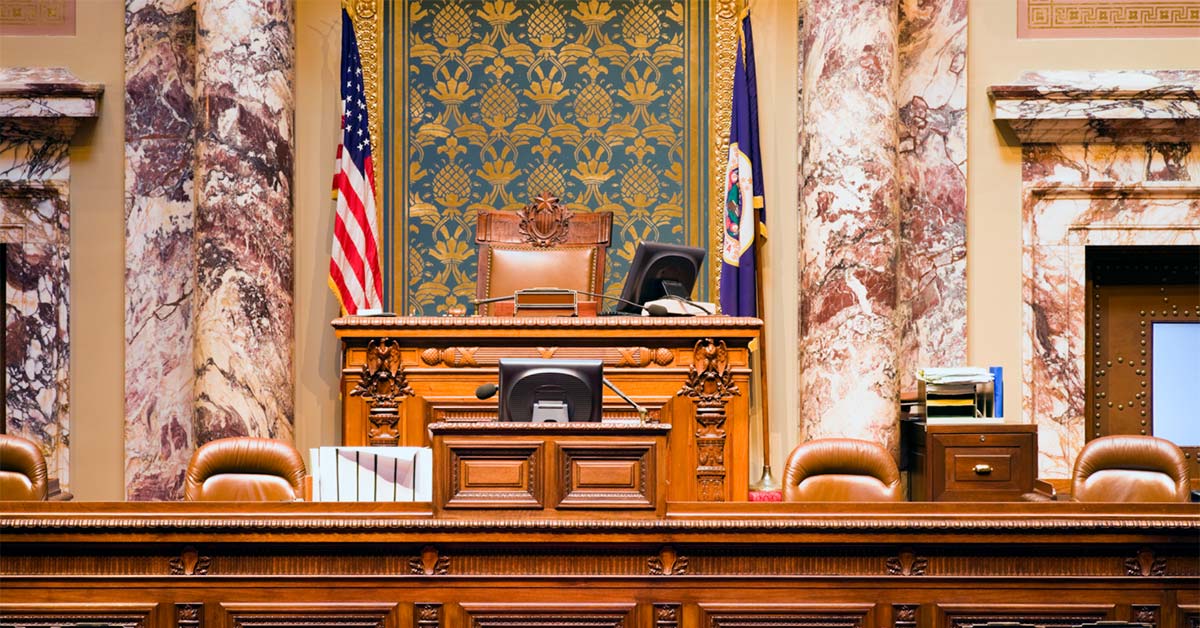

July 8, 2021 - On July 1, 2021, Governor Walz signed a bevy of new bills into law, including both a $52B budget bill and a tax bill that benefits many Minnesota business and individual taxpayers. Below is a summary of some of the provisions in the bills:

As a result of the new law, partnerships, limited liability companies, and S corporations now have the option to pay the Minnesota state tax liability for their entity income as though they were a C corporation. This election allows the owners of electing entities to deduct their Minnesota taxes at the entity level rather than on their individual returns which lessens the impact of the $10,000 state tax cap on their individual tax returns.

Some specifics of the new Pass-through entity tax election are as follows:

This new entity-level taxation option puts Minnesota in a growing list of states that have changed their laws to allow “pass-through” entities to elect to pay the entity state tax liability at the entity level rather than the individual level to lessen the impact of the $10,000 state tax cap on itemized deductions.

Additional information will be provided as additional details become available. The Minnesota Department of Revenue is still trying to determine what if anything is required from taxpayers. Depending on the complexity of the adjustment the Department will either adjust your return and issue refunds or require the filing of amended returns.

This article was originally written in October 2020. It has been updated with new references and information.

Editor's note: this blog was updated in 2025 with additional resources for business owners.

In a significant shift on Friday, March 21, the Financial Crimes Enforcement Network(FinCEN) has revised its Beneficial Ownership Information (BOI)...