The Hidden Value of a QoE: Better Diligence, Better Audits

For searchers, a Quality of Earnings (QoE) engagement does more than support a transaction. It sets the foundation for smoother financial reporting...

3 min read

Nikki Bocock

:

July 31, 2018

Nikki Bocock

:

July 31, 2018

July 31, 2018 — Have you itemized in previous tax years? Should you itemize deductions for 2018? You may not, because it might not make the most sense anymore!

The Tax Cuts and Jobs Act (TCJA) has eliminated exemptions, increased the standard deduction, and changed many of the deductions listed on Schedule A of your 1040.

*Note these changes are temporary and are in effect for 2018-2025.

Under the pre-TCJA, an individual reduced their adjusted gross income (AGI) by any personal exemption deductions and by either the applicable standard deduction or with itemized deductions. Personal exemptions were allowed for the taxpayer, taxpayer’s spouse, and any dependents.

The TCJA has eliminated the deduction for exemptions.

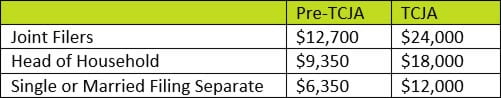

Taxpayers who don’t itemize may reduce their AGI by the applicable standard deduction. This has not changed pre or post-TCJA, however, the amount of the standard deduction has almost doubled.

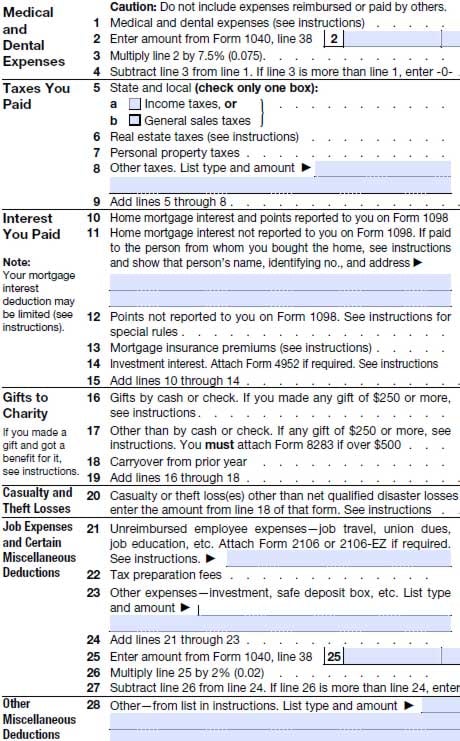

The medical expense deduction has been enhanced for 2017 and 2018. Medical expenses in excess of 7.5% of your total adjusted gross income are deductible. After 2018 this threshold reverts to 10% as was in effect before the TCJA.

Under pre-TCJA, taxpayers could deduct the following taxes; state, local, and foreign real property taxes, state and local personal property taxes, state, local and foreign income, war profits, and excess profits taxes. Taxpayers could also elect to deduct state and local general sales taxes instead of state and local income taxes.

Under the TCJA, taxpayers are now limited to a $10,000 deduction in aggregate for state and local real property taxes, state and local personal property taxes, state and local, and foreign income, war profits, excess profits taxes, and general sales taxes. Foreign real property tax may no longer be deducted unless it is paid or accrued in carrying on a trade or business (then it should be reported on the taxpayer’s business activity expenses).

Under pre-TCJA rules, taxpayers were able to deduct qualified residence interest that was paid or accrued during the tax year on the acquisition indebtedness that was secured by a qualified residence. This interest also included home equity indebtedness that was secured by a qualified residence. The deduction was limited to interest paid on up to $1 million of acquisition debt and up to $100,000 home equity debt pre-TCJA.

Under the TCJA, the deduction for home equity interest has been suspended for tax years 2018 - 2025. Furthermore, the interest deduction is limited to interest incurred on up to $750,000 of acquisition debt. However, Debt that was incurred on or before Dec. 15, 2017 still remains subject to the $1 million acquisition debt limit.

For taxpayers that had a binding contract written before Dec. 15, 2017 to close on the purchase of a primary residence before Jan. 1, 2018, and closed before Apr. 1, 2018, the $1 million limitation will still apply.

Mortgage insurance premiums are no longer deductible.

Under pre-TCJA law, generally, taxpayers were able to deduct contributions of cash to charitable organizations up to 50% of their adjusted gross income. The TCJA has increased the 50% limitation to 60%. There are limitations now in place as well that will limit your non-cash contributions if your cash and non-cash contributions exceed 60%/30% of your adjusted gross income. If you plan on making large donations, please contact your tax advisor first for more details. Any deductions that exceed the limitation will still be carried forward up to 5 years from the tax year the donation occurred.

The deduction for casualty and theft losses is repealed except for losses relating to a federal disaster.

The TCJA has eliminated all miscellaneous itemized deductions to which the 2%-of-AGI floor applied. Some of the more common deductions include:

This section of itemized deductions has not been affected by the TCJA. They include but are not limited to amortizable bond premium, estate tax on income in respect of a decedent (IRD), impairment-related work expenses, or repayments of more than $3,000 under a claim of right.

The TCJA has also eliminated the reduction of itemized deductions by 3% when a taxpayer’s AGI exceeds certain threshold amounts.

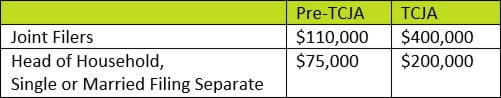

The TCJA has increased the maximum Child Tax Credit from $1,000 to $2,000 for each qualifying child under the age of 17 and has also increased the threshold at which the credit begins to phase-out. See below for the modified AGI thresholds at which the Credit begins to phase-out. This means that many taxpayers who weren’t able to take advantage of this credit in the past will now be eligible for this increased credit.

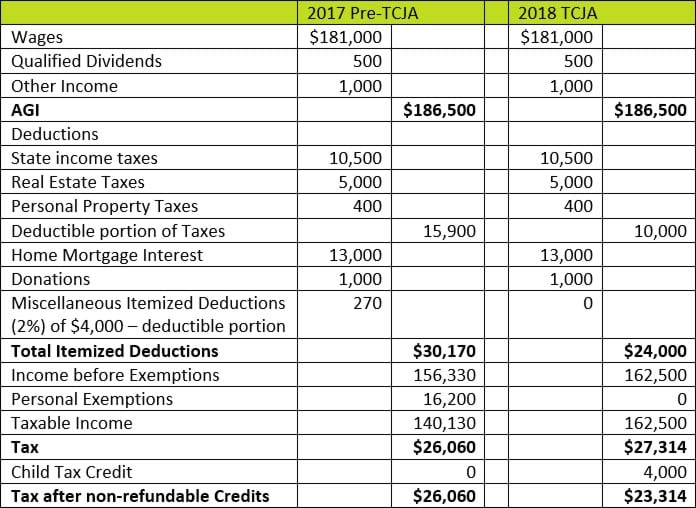

See below how the TCJA would affect a married couple with 2 dependents under age 17.

With all the changes noted above, you will need to analyze your tax situation carefully. In certain years it may no longer be advantageous to itemize! Consult your tax advisor to plan appropriately. You can maximize your deductions by properly planning for the timing of certain expenditures that give rise to a deduction—this process is called “bunching” and you can learn more about it in our recent article on the subject.

If you have questions about personal tax, reach out to Gloria McDonnell, Partner and Tax Operations Director at Redpath and Company.

For searchers, a Quality of Earnings (QoE) engagement does more than support a transaction. It sets the foundation for smoother financial reporting...

In most M&A conversations, risk can be oversimplified too quickly. Buyers ask, “What if we overpay?” Sellers worry, “What if we leave money on the...

For independent searchers, structuring the right deal isn’t just about finding a great business. It’s about creating the right balance between risk...