The Hidden Value of a QoE: Better Diligence, Better Audits

For searchers, a Quality of Earnings (QoE) engagement does more than support a transaction. It sets the foundation for smoother financial reporting...

2 min read

John Kammerer, CPA

:

June 7, 2018

John Kammerer, CPA

:

June 7, 2018

June 7, 2018 — The Tax Cuts and Jobs Act (TCJA) created many changes for both individuals and businesses. These changes include the repeal of the Domestic Production Activities Deduction (DPAD or Section 199) and the creation of the new Section 199A deduction for individual owners of pass-through entities.

The Section 199A deduction is more expansive than DPAD, and can be better in the following ways:

Under the repealed DPAD rules, manufacturers of tangible property and limited contract processing/manufacturing and distribution activities were eligible to claim a 9% deduction of the net income from qualifying domestic production activities. For tax years beginning after December 31, 2017, the new Section 199A Qualified Business Income Deduction (QBID) allows an individual a deduction of 20% based on an individual’s domestic qualified business income from a pass-through entity (i.e. partnership, S Corporation, or sole proprietorship).

Most manufacturers’ income should qualify for the 20% deduction because manufacturing meets the definition of a “qualified trade or business”. A qualified trade or business includes any trade or business other than a “specified service trade or business”, e.g. law firms, financial advisors, etc., or the trade or business of performing services as an employee. The 199A deduction gives more weight to W-2 income than the repealed Section 199 calculation which implies Congress meant to promote employment as well.

The Section 199A deduction was created along with the tax rate reduction that was given to C Corporations in the TCJA. Starting January 1, 2018, C Corporation rates went from the maximum rate of 35% to a 21% flat rate. The TCJA has reduced the top individual tax rate to 37% from 39.6%, so an owner of a pass-through business who can deduct the full 20% of pass-through income effectively reduces their top effective tax rate to 29.6%.

The basic Section 199A qualified business income pass-through deduction is 20 percent of net qualified business income. However, there can be limitations to this deduction based upon the wages paid by the business.

Qualified business income—i.e., manufacturing income from your pass-through, for a tax year is generally the lesser of:

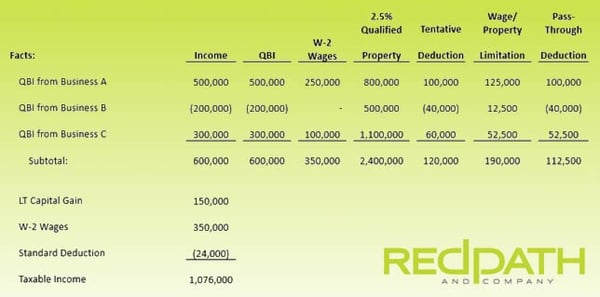

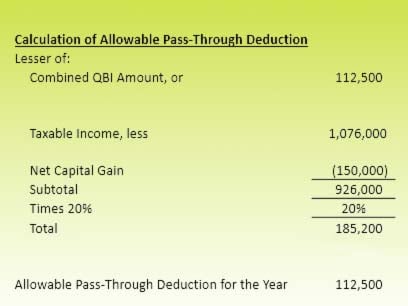

Above: Facts Around an Example Pass-Through Structure, Below: A Subsequent Calculation

For searchers, a Quality of Earnings (QoE) engagement does more than support a transaction. It sets the foundation for smoother financial reporting...

In most M&A conversations, risk can be oversimplified too quickly. Buyers ask, “What if we overpay?” Sellers worry, “What if we leave money on the...

For independent searchers, structuring the right deal isn’t just about finding a great business. It’s about creating the right balance between risk...