Advanced ESOP Accounting Topics: Warrants, SARs, and Planning Ahead

For companies entering or operating within an ESOP, the transaction itself is often the headline moment. Ownership changes, employees become owners,...

2 min read

John Kammerer, CPA

:

November 6, 2017

John Kammerer, CPA

:

November 6, 2017

November 6, 2017 — On November 2nd, the House GOP released the Tax Cuts and Jobs Act. While the Act still has some major hurdles to clear before it becomes law, many business owners are already beginning to analyze the potential impact to them and their businesses. The Act is very broad and would impact a wide range of areas. After our initial review of the Act, it appears the choice of entity could be one of the most significant areas business owners will have to analyze.

Generally, businesses have a choice to be taxed as

A number of factors impact this decision, including

Under current law, many businesses benefit by choosing to be taxed as pass-through entities. The primary reasons are that

Among the many changes impacting businesses and their owners, the tax rate changes and the limitation on the ability of individuals to deduct state and local income taxes result in some significant changes to the analysis.

Under the Act, C corporation tax rates would be reduced from a top rate of 35% to a flat tax rate of 20%. In addition, the tax rate on pass-through entities was reduced from a top rate of 39.6% to a top rate of 25%. However, the 25% rate only applies to the portion of the taxable income considered to be related to capital which under the general rule is 30% (0% for certain service businesses). The regular rates, as well as self-employment taxes, will apply to the remaining income. For passive owners, the 25% rate will apply to all of the income.

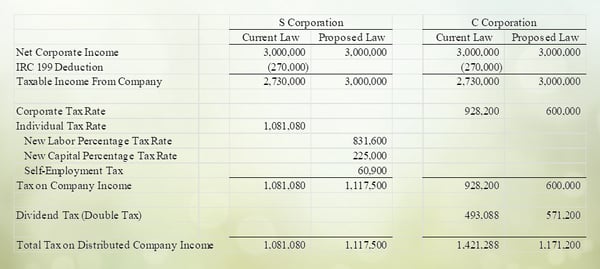

The following example helps illustrate the potential impact of the law changes of a business operated as a C corporation and an S corporation under both the current law and the new law. To simplify the comparison, the calculation below assumes that the shareholders are active in the business, not subject to state tax, and subject to the top rates. The calculation also assumes that all the activity qualifies for the domestic production deduction.

As the calculation illustrates, the proposed changes have the potential to increase taxes on businesses operating as pass-through entities. There are a number of factors that can impact the analysis for individual taxpayers, including

C corporations stand to benefit significantly from the proposed law. Company level taxes would decrease significantly and the spread between the taxes on operating profit from a C corporation to an S corporation would increase compared to current law. While the effect of the second level of tax still results in a higher tax overall, the timing of that tax can be controlled and the impact is decreasing.

Ultimately, there are still a lot of things to consider in the choice of entity analysis. As we approach year end, we are carefully monitoring the tax reform bill and the potential impact to our clients. If the Act were to pass without substantial modification, many of our clients would need to consider whether their current entity type still makes sense.

For companies entering or operating within an ESOP, the transaction itself is often the headline moment. Ownership changes, employees become owners,...

For searchers, a Quality of Earnings (QoE) engagement does more than support a transaction. It sets the foundation for smoother financial reporting...

In most M&A conversations, risk can be oversimplified too quickly. Buyers ask, “What if we overpay?” Sellers worry, “What if we leave money on the...