3 Questions to Find the Right Accounting Partner for Your Construction Business

This article was originally written in October 2020. It has been updated with new references and information.

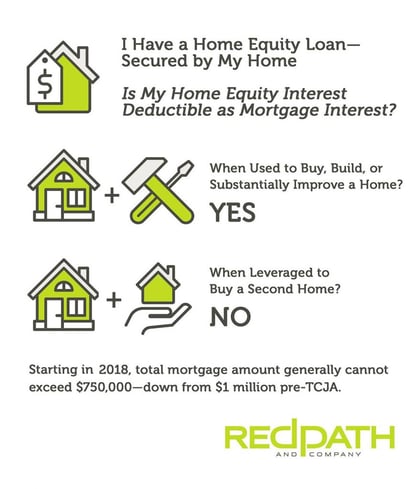

March 1, 2018 — The Tax Cuts and Jobs Act passed in December changed the rules regarding the deductibility of mortgage and home equity loan interest. Prior to the law change interest on up to $1,000,000 of home acquisition debt and interest on up to $100,000 of home equity debt was deductible.

Starting in 2018, $750,000 is the maximum amount of debt that can be treated as home acquisition debt for purposes of the mortgage interest deduction. Under the new law interest on home equity debt is no longer deductible.

The IRS has recently issued guidance clarifying this limitation. Interest expense from a home equity loan or home equity line of credit may be deductible as mortgage interest expense if the following criteria are met:

It is important to note that a taxpayer will not be allowed the home equity interest deduction if he or she takes out a home equity loan on his or her main home and uses the loan proceeds to purchase or remodel a second home.

The new dollar limits on mortgages under the new law ($750,000) of acquisition indebtedness still apply. This limit applies to the combined balance of the first mortgage and the home equity loan. Following are some examples from the recently issued Information Release IR 2018-32 illustrating the application of these rules:

Illustration 1: In January 2018, John takes out a $500,000 mortgage  to purchase a main home with a fair market value of $800,000. In February 2018, he takes out a $250,000 home equity loan to put an addition on the main home. Both loans are secured by the main home and the total does not exceed the cost of the home. Because the total amount of both loans does not exceed $750,000, all of the interest paid on the loans is deductible. However, if John used the home equity loan proceeds for personal expenses, such as paying off student loans and credit cards, then the interest on the home equity loan would not be deductible.

to purchase a main home with a fair market value of $800,000. In February 2018, he takes out a $250,000 home equity loan to put an addition on the main home. Both loans are secured by the main home and the total does not exceed the cost of the home. Because the total amount of both loans does not exceed $750,000, all of the interest paid on the loans is deductible. However, if John used the home equity loan proceeds for personal expenses, such as paying off student loans and credit cards, then the interest on the home equity loan would not be deductible.

Illustration 2: In January 2018, Mary takes out a $500,000 mortgage to purchase a main home. The loan is secured by the main home. In February 2018, she takes out a $250,000 loan to purchase a vacation home. The loan is secured by the vacation home. Because the total amount of both mortgages does not exceed $750,000, all of the interest paid on both mortgages is deductible. However, if Mary took out a $250,000 home equity loan on the main home to purchase the vacation home, then the interest on the home equity loan would not be deductible.

Illustration 3: In January 2018, Bob takes out a $500,000 mortgage to purchase a main home. The loan is secured by the main home. In February 2018, he takes out a $500,000 loan to purchase a vacation home. The loan is secured by the vacation home. Because the total amount of both mortgages exceeds $750,000, not all of the interest paid on the mortgages is deductible. Only a percentage of the total interest paid is deductible.

For taxpayers itemizing deductions on their individual tax return, the mortgage interest deduction and the home equity interest deduction are both still a valuable component of your tax planning. For more information on the mortgage interest or home equity interest deduction, please contact Gloria McDonnell.

This article was originally written in October 2020. It has been updated with new references and information.

Editor's note: this blog was updated in 2025 with additional resources for business owners.

In a significant shift on Friday, March 21, the Financial Crimes Enforcement Network(FinCEN) has revised its Beneficial Ownership Information (BOI)...