The Hidden Value of a QoE: Better Diligence, Better Audits

For searchers, a Quality of Earnings (QoE) engagement does more than support a transaction. It sets the foundation for smoother financial reporting...

3 min read

Gloria McDonnell, CPA

:

November 3, 2017

Gloria McDonnell, CPA

:

November 3, 2017

November 3, 2017 — On November 2, the House released the long-awaited Tax Cuts and Jobs Act. The Act is broad and covers multiple aspects of individual and corporate taxation. The Act, which is not yet law, will likely see some changes before it is finalized.

We will be releasing summaries of specific areas of the act over the next couple of weeks as we continue our in-depth analysis of the lengthy Act.

The summary below reflects some of the major tax law changes contained in the Act.

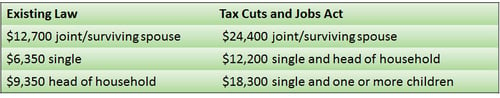

Personal exemptions are eliminated under the Tax Cuts & Jobs Act

Pass-through income treated as business income will be subject to a reduced 25% tax rate. Individual tax rates and self-employment tax rates apply to the remainder of pass-through income. The business income is determined by the taxpayer’s “capital percentage” which is generally 30%. Certain industries may be eligible for an increased rate. Business income from certain service businesses is not eligible for the 25% rate on business income.

While there is still a long way to go before The Tax Cuts and Jobs Act becomes law, the bill has the potential to dramatically change our current tax system. Businesses and individuals alike will need to consider the potential impact on some decisions they have made or are considering including their choice of business entity, their decision to utilize debt for the financing of certain investments, and also the groupings of certain business interests. We will continue to provide additional updates as the bill moves through Congress.

If you have any questions regarding how the Tax Cuts and Jobs Act may impact you or your business, please contact Redpath and Company tax partners John Kammerer and Gloria McDonnell:

John Kammerer, CPA, Partner

651-255-9305

jkammerer@redpathcpas.com

Gloria McDonnell, CPA, Partner

651-407-5829

gmcdonnell@redpathcpas.com

For searchers, a Quality of Earnings (QoE) engagement does more than support a transaction. It sets the foundation for smoother financial reporting...

In most M&A conversations, risk can be oversimplified too quickly. Buyers ask, “What if we overpay?” Sellers worry, “What if we leave money on the...

For independent searchers, structuring the right deal isn’t just about finding a great business. It’s about creating the right balance between risk...