Redpath Welcomes Mike Dunkle as a Transaction Advisory Services Partner

ST. PAUL, MN – February 3, 2026 – Redpath and Company is pleased to welcome Mike Dunkle as a Partner in the firm’s Transaction Advisory practice....

January 31, 2018 — Last November, we examined the potential impact of Tax Reform on Choice of Entity. Since the Tax Cuts and Jobs Act was signed into law on December 22, 2017, taxpayers have been working through the changes to try and understand the impact to themselves and their businesses. The Act impacted many areas of the tax law and, as a result, has caused many taxpayers to reconsider their current entity structure.

Generally speaking, businesses have the choice to be taxed as a C Corporation, where the entity pays the tax liability, or a pass-through business where the owners of the business are subject to tax on their distributive share of the income. Owners of pass-through entities pay tax when the income is earned but do not pay tax again when the profits are distributed to the owners. This single level of tax is the primary reason businesses choose to be organized as a pass-through entity. In contrast, profits from C Corporations are “double taxed” as dividend income when paid to the owners.

The easiest way to demonstrate the differences is to walk through an example that compares a pass-through entity with a C corporation on earned income that is retained, and then contrast that to earned income that is distributed out to the owners.

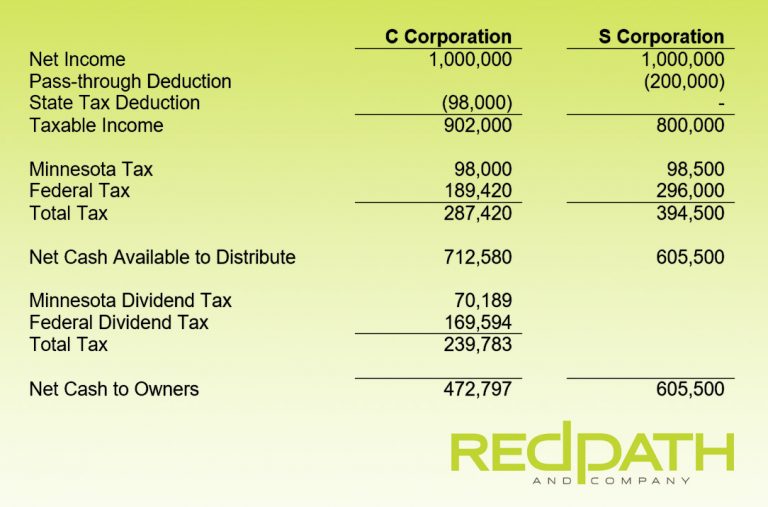

The following calculation compares an S corporation to a C corporation where the income is fully taxed in Minnesota. The calculation assumes the owners are in the top tax brackets and active in the business.

What the example helps illustrate is that C corporations can result in less tax on retained profits but pass-through entities can result in less tax on profits distributed to the owners. So what is the right answer?

The choice of entity analysis takes into account the rates as illustrated above but also considers a number of factors, including:

As the above list of considerations illustrates, choosing the right entity type can be a complicated analysis that needs to consider a wide range of issues.

The Tax Cuts and Jobs Act has provided the incentive for many taxpayers to reconsider their current structure due to the potential benefits. If you have any questions regarding how the Act may impact you or your business, please contact John Kammerer, Partner, and Business Tax Service Area Leader today.

ST. PAUL, MN – February 3, 2026 – Redpath and Company is pleased to welcome Mike Dunkle as a Partner in the firm’s Transaction Advisory practice....

The Redpath and Company BottomLine Newsletter ishere!

As 2025 drew to a close, the Governmental Accounting Standards Board (GASB) issued Statement No. 105, Subsequent Events. While the requirement to...