3 Questions to Find the Right Accounting Partner for Your Construction Business

This article was originally written in October 2020. It has been updated with new references and information.

4 min read

John Kammerer, CPA

:

February 17, 2017

John Kammerer, CPA

:

February 17, 2017

February 17, 2017 — Business succession planning is most likely not one of the top “to-dos” on your list of priorities. But as a business owner working hard every day to run a successful enterprise, it should be. Whether you're considering an exit strategy today or further down the road, it's critical to properly position yourself and your business to maximize the opportunity. Waiting until you're ready or forced to sell is not a strategy—and creates the potential for leaving cash on the table. Poor planning and preparation could also mean working longer than you want or having a transaction fall through altogether.

In a seminar last year sponsored by Redpath and Company, with presentations from Paul Cronin of Cornerstone3 and Justin Besikof and Jake Fishman of Madeira Partners, it became clear that just thinking about selling your business is not a strategy. There are some vital steps, strategies, and metrics you can use to help ensure a positive and profitable transition.

Paul Cronin points out that according to the U.S. Chamber of Commerce, just 20% of companies put up for sale are sold—meaning 4 out of 5 owners walk away empty handed. An estimated 65-75% of would-be sellers never even make it to market.* And while those stats are sobering enough, only 1 in 10 owners received anywhere near the value they expected with the sale of their business.* The bottom line is that business owners struggle with creating a business that is attractive to a buyer.

Cronin states that financial buyers (the most common type) are actually buying the predictability of your future stream of profit. Business owners have two “levers” to pull that can drive up the value of your company:

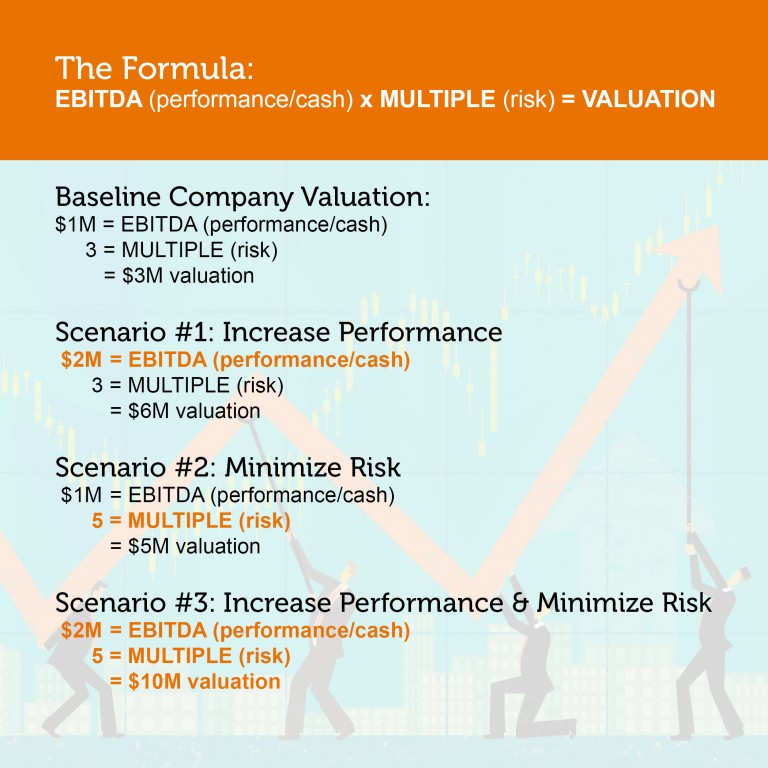

As the business leaders focus on the performance of the enterprise while minimizing risk for the potential buyer, it’s easy to see how a valuation changes with the following formula: EBITDA (cash) x MULTIPLE (risk) = VALUATION. Increase performance and the valuation goes up. Minimize risk and the multiple goes up. Increase performance and minimize risk? Now you’ve positioned your business to be sold for its greatest value.

Cronin identifies 4 barriers to scaling up: leadership, marketing, scalable infrastructure, and cash.

In addition to the 4 Barriers to Growth, Cronin also identifies 4 areas you need to address in order to scale up your business. He states that scaling a business is about asking and answering great questions. Those questions and answers are:

Emerging trends in M&A indicate the current environment is highly competitive driven by easy financing, a glut of private equity groups, and cash-rich strategies. Valuation multiples are near historic highs for businesses that have explosive growth, proprietary products, and services, or niche positions in key industries.

To help you prepare for the process of engaging in a very complex and competitive M&A environment, Justin Besikof and Jake Fishman of Madeira Partners provide some insights to help you with the sale of your business.

First Steps:

Financial Preparation

Operational Preparation

Management and Organization

Due Diligence Preparation

It’s never too early to start planning for your own future, as well as the future of your business. With many short and long-term considerations, today is better than tomorrow to get your proverbial “house in order.” Of course, when things are going well, it’s fun to go to the office everyday—and it’s difficult to think about selling the business. But remember, that’s when your business is the most valuable as well.

Once you start taking some early steps to increase your enterprise value, you’ll be happy that you did so down the road. Companies that demonstrate steady, consistent growth dramatically outperform organizations that experience wild swings in revenue and profit. The company with a predictable, steady pace that is driven by a market-dominating strategy, scalable systems, and effective processes attracts the top talent—and creates products and services that satisfy their customers’ needs. And those are the companies that generate significant wealth.

Paul Cronin, Senior Business Adviser at Cornerstone3, works exclusively with entrepreneurs and action-oriented business owners to eliminate frustrations, achieve breakthrough growth, and maximize the value of their company. He also works with exiting owners to plan their succession and help execute their business transition.

Justin Besikof, Founder and President of Madeira Partners, has spent his entire career successfully executing middle market M&A transactions, including sales to strategic and private equity groups, recapitalizations and buyouts.

Jake Fishman, Managing Director of Madeira Partners, has experience in mergers and acquisitions, private equity transactions, corporate finance, special situations advisory and financial restructuring. Jake specializes in representing the sellers of closely-held, family owned and private equity sponsored companies.

This article was originally written in October 2020. It has been updated with new references and information.

Editor's note: this blog was updated in 2025 with additional resources for business owners.

In a significant shift on Friday, March 21, the Financial Crimes Enforcement Network(FinCEN) has revised its Beneficial Ownership Information (BOI)...