3 Questions to Find the Right Accounting Partner for Your Construction Business

This article was originally written in October 2020. It has been updated with new references and information.

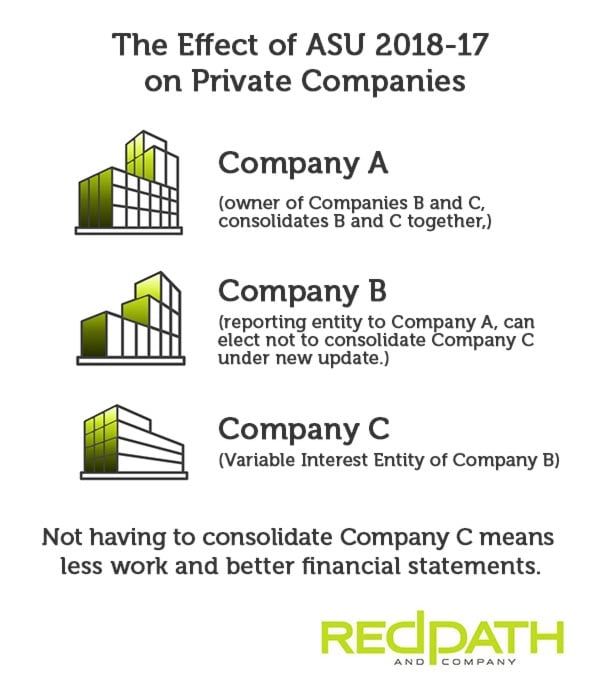

November 26, 2018 — On October 31, 2018, the Financial Accounting Standards Board (FASB) issued an update to the Consolidation guidance pertaining to Variable Interest Entities (VIE’s) for private companies. This is good news for these companies and users of these statements as they may see reduced financial reporting expenses and be able to create GAAP-compliant financial statements that are more useful for their users.

The amendment in this Update (ASU 2018-17) affects reporting entities that are required to determine whether they should consolidate a legal entity under the guidance within the VIE Subsections of Subtopic 810-10 (consolidations), including private companies that have elected the accounting alternative for leasing arrangements under common control. The Update does not apply to public business entities and not-for-profit entities, as defined.

Private Companies may elect not to apply VIE guidance to legal entities under common control (including common control leasing arrangements) if both the parent and the legal entity being evaluated for consolidation are not public business entities.

A private company can elect this accounting alternative to all current and future legal entities under common control that meet the criteria for applying this alternative. This alternative cannot be applied to select common control arrangements—in other words, the private company cannot pick which relationships to apply this alternative to—it’s all or nothing.

In 2014, the FASB issued an accounting alternative for common control leasing arrangements to not apply the VIE guidance; this alternative expands that alternative to include all private company common control arrangements.

This accounting alternative should reduce diversity in applying VIE guidance to private companies under common control because it is expected that many private companies will elect the alternative. This accounting alternative is also expected to improve the relevance of the financial reporting information to users by providing users of private company financial statements with additional disclosures structured in a more consistent manner.

A common control arrangement that meets the requirements of this amendment shall disclose the following:

For private companies, the amendments are effective for fiscal years beginning after December 15, 2020. If adopted, entities are required to apply the amendments in this Update retrospectively with a cumulative-effect adjustment to retained earnings at the beginning of the earliest period presented. Early adoption is permitted, and you may want to take advantage of that.

Your financial statements will be better for your users, and it will remove some of the work you have been required to do up until this Update. If you have any questions about this Update, or have any assurance and accounting concerns, you can reach out to Jill Noack at jnoack@redpathcpas.com or (651) 407-5867.

This article was originally written in October 2020. It has been updated with new references and information.

Editor's note: this blog was updated in 2025 with additional resources for business owners.

In a significant shift on Friday, March 21, the Financial Crimes Enforcement Network(FinCEN) has revised its Beneficial Ownership Information (BOI)...