3 Questions to Find the Right Accounting Partner for Your Construction Business

This article was originally written in October 2020. It has been updated with new references and information.

7 min read

Redpath and Company

:

August 10, 2021

Redpath and Company

:

August 10, 2021

August 10, 2021 - Editors Note: This blog was originally published in September 2019 and has been updated for accuracy.

In today’s evolving business environment, businesses rely on accounts payable for the important task of paying vendors for goods and services. For some companies, this involves numerous transactions and maintaining vendor relationships that help companies grow. While generating revenue from customers is a major goal of any business, accounts payable is equally important on the expense side of the business.

Managing accounts payable has a two-fold effect for the business; expenses paid are accounted for in the financials, and the income paid to other individuals and businesses is accounted for for tax reporting purposes. This post will focus on the latter—on maintaining vendor records for tax reporting.

Most businesses utilize vendors to perform services to fulfill a business need. Some examples of services include but are not limited to:

Services performed by non-employees, or vendors, will fall under the independent contractor worker classification. This income is reportable by the paying entity (active in a trade or business) and will trigger form-filing requirements to report the income paid, in most cases on form 1099-MISC. Employees, on the other hand, have their income paid reported on Form W-2. The chart below provides an example of the form reporting based on worker classification. It is important to keep in mind that this extends to global relationships companies have as well. Businesses may also incorporate utilizing a foreign vendor—a vendor outside of the United States—to provide services to them. For more information on foreign vendor reporting, see our blog post Requirements for Withholding on Payments to Foreign Vendors.

|

Worker Classification Type |

Year-end Tax Reporting Form |

|

Employee |

W-2 |

|

Independent Contractor |

1099 |

|

Foreign Independent Contractor |

1042-S |

|

Worker Classification Type |

Taxpayer Identification Form |

|

Employee |

W-4 |

|

Independent Contractor |

W-9 |

|

Foreign Independent Contractor |

W-8 (BEN, BEN-E, EXP, IMY, ECI) |

While this post focuses on the form requirements and accounts payable processes for classified independent contractors, every business is responsible for choosing the proper worker classification when hiring a worker to perform services for their company. If you have specific questions regarding worker classification for your company, please contact your client manager.

Some common questions that clients ask:

Proper documentation on the front end of any new vendor relationship through accounts payable is the most pivotal part of maintaining records and reporting for year-end.

Business owners are busy trying to run the business, keep cash flow moving, and focus on their customers. However, often due to all the flurry of activity, bills due through accounts payable may not receive the highest attention to ease into year-end reporting. Without a dedicated accounts payable person, vendors are generally set up in accounting software without a complete profile established with address, tax ID, legal business name, and tax entity type.

The following outlines some accounts payable best practices that businesses can adopt to ease the tension of year-end close.

Example: A business hires a lawn service company to provide lawn care during the summer months at their office location. Upon signing the contract for the lawn care, the business owner requests a W-9 from the vendor prior to services being performed. Generally, the salesperson who you signed the contract with will not have this readily available. The work starts regardless, the first month of lawn care is complete, and you received the first bill for services provided without the W-9 for your records. Prior to issuing the bill payment, re-request directly at their billing office a copy of their W-9. This will encourage the vendor to follow through knowing it will delay payment to them.

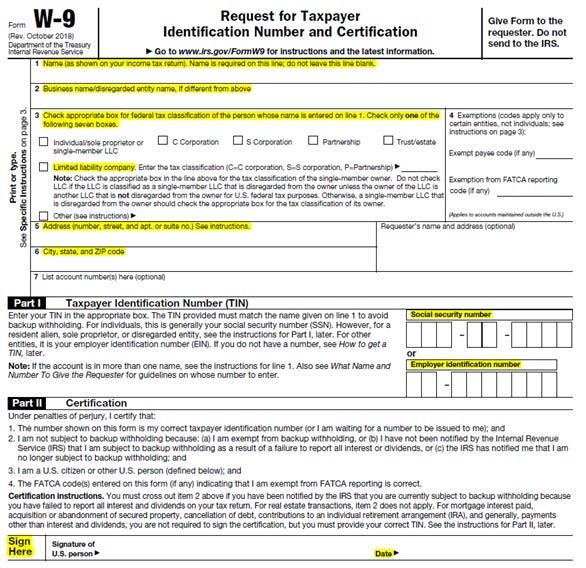

The blank W-9 below shows the highlighted fields that are most commonly completed and needed for tax reporting purposes.

Example: You received the lawn care service company’s Form W-9. Most accounting systems allow you to quickly enter the vendor by inputting the business name only, and to then immediately move forward to issuing payment. Because you already have all the taxpayer’s information from the W-9, edit the vendor profile to completely fill in the legal business name, address, taxpayer ID number and entity type.

The entity type matters at year-end, as most corporations are exempt from 1099 reporting. There are exceptions to this rule! By taking the time on each vendor individually at the event of first-time payment, you will find year-end reports complete and ready for review and reporting. Keep in mind that every accounting software is different when it pulls in the vendor information for 1099 reporting. Always double check all applicable 1099 vendors make the list.

Example: The same lawn care service provider charged you for mulch, which would be goods, not services. In general, goods are not 1099 reportable. However, when they are listed together on the same invoice with services, the entire amount paid for both goods and services would be reportable on the 1099. If however, the lawn care provider invoices separately for the mulch, only the service invoices would be reportable. Having the support linked in your accounting software can help you easily determine year-end amounts to be used on the 1099 reporting.

It is especially important to re-request an updated W-9 from a vendor you receive a B-Notice—this notice usually means something with the EIN/SSN provided does not match the tax entity name associated to it. Some issues could include that a business changed their name, provided a DBA (doing business as) name instead of the legal name, or the vendor may have simply filled out the W-9 in error.

This is especially common with sole proprietorships. Sole proprietorships, while they may have an EIN, will be recognized by the individuals SSN and name along with the doing business as name. Combing through your vendor list is a good way to designate old vendors as inactive in order to clear out excess names and allow you to focus on maintaining complete profiles on the vendors you regularly use.

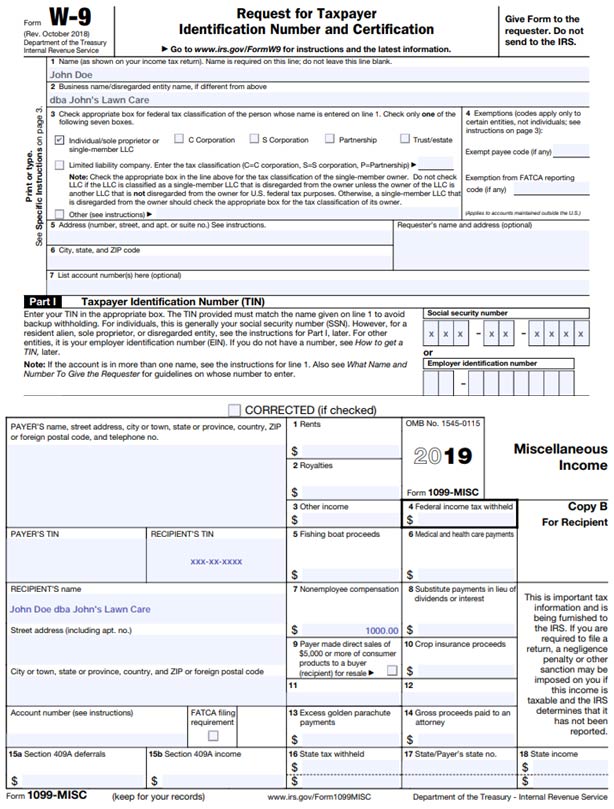

Example: You receive a W-9 from John Doe, doing business as John’s Lawn Care. On the W-9, John checks the Individual/Sole proprietor or single-member LLC box but only lists John’s Lawn Care and EIN. For 1099 reporting, the 1099 will need to list John’s individual name associated with the business and not the DBA name alone—the IRS will then have an easier time matching it to John’s individual name and SSN than if the DBA name and EIN had been used instead in these sole proprietor instances.

Example: John’s Lawn Care accepts either credit card or check for remittance on their invoices to you. Based on the year-end vendor report, you are able to break out the detail by transaction and determine that in total you paid John’s Lawn Care $1,500.00 for the year. If $500 of that total was paid by credit card transactions, only $1,000 would be reportable on the 1099-MISC for services provided. In the accounting software, it is important to pay the bill or record the expense using the correct payment type coding.

It is important and encouraged to maintain clean vendor records to be ready for an audit and also for tax reporting purposes. Most of the items in this blog come from experience working with clients as they navigate one of the busiest times of the year for their companies. That month is January! During that month, or shortly before or after it, many businesses perform year-end closes, issue W-2’s to their employees, and compile lists for 1099 reporting. From experience, it can be a stressful time for businesses to fit in so many important tasks into a short 31-day window. This time of year is very important as the taxing agencies rely on businesses to correctly report payments made to other individuals and businesses.

While it can pose a challenge to focus on the big picture of your business and growth, it is always a good idea to allocate time or resources to the finer details of your company to strive for compliance and record keeping excellence in your accounts payable.

This article was originally written in October 2020. It has been updated with new references and information.

Editor's note: this blog was updated in 2025 with additional resources for business owners.

In a significant shift on Friday, March 21, the Financial Crimes Enforcement Network(FinCEN) has revised its Beneficial Ownership Information (BOI)...